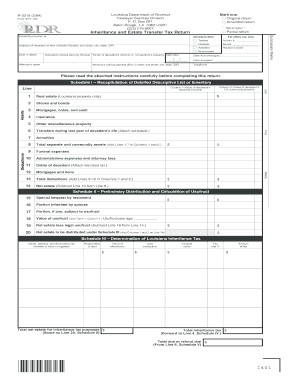

louisiana inheritance tax return form

2021 Louisiana Nonresident Income Tax Return. In fact as discussed below the Louisiana Department.

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

No inheritance tax is owed and theres no need to file an Inheritance and Estate Tax Return with the Louisiana Department of Revenue.

. An inheritance tax is a tax imposed on someone who inherits money from a deceased person. In other words if you purchased your home in the 80s for. Payment of the tax due must accompany the.

Form IT-540 Tax Tables. Louisiana Estate and Inheritance Tax Return Engagement Letter - 706 To access and download state-specific legal forms subscribe to US Legal Forms. Online applications to register a business.

In its most basic form separate property is everything that isnt. Some states levy an inheritance tax on money or assets after they are passed on to a persons heirs. 2022 Estimated Tax Voucher.

Access your account online. REV-346 -- Estate Information Sheet. File your clients Individual Corporate and.

Louisiana Department of Revenue Taxpayer Services Division P. The irs will evaluate your request and notify you. REV-229 -- PA Estate Tax General Information.

REV-485 -- Safe Deposit Box Inventory. Fill Free fillable Louisiana Real Estate Commission PDF forms from fillio. File returns and make payments.

Find out when all state tax returns are due. It is indexed for inflation and for deaths occurring in calendar year 2020 the exempt amount is 1158 million for an individual and twice that for a married couple. For office use only.

Simply select the form or package of. Form 1029 sales tax return. Box 201 Baton Rouge LA 70821-0201 225 219-0067 Inheritance and Estate Transfer Tax Return Mark one.

It operates almost like an inheritance tax on the heirs but it is much more severe and it is levied through the INCOME TAX SYSTEM. While the estate is responsible for paying. Dont confuse estate tax with inheritance tax.

REV-487 -- Entry Into Safe Deposit.

Louisiana Probate Forms Signnow

Selecting A Trust Situs Colorado Lawyer

Where S My State Refund Track Your Refund In Every State

Your Money Understanding How To Fill Out The W 4 Form

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

Llc In Louisiana How To Start An Llc In Louisiana Nolo

Estate Taxes New Orleans Orleans Parish Louisiana Lawyer Attorney Law Firm

Louisiana Sales Tax Small Business Guide Truic

Renunciation Of An Inheritance In Louisiana Scott Vicknair Law

Complete Guide To Probate In Louisiana

Inheritance Baton Rouge Fill Online Printable Fillable Blank Pdffiller

Complete Guide To Probate In Louisiana

Is Estate Tax Owed On Living Trust Assets Youtube

Form R 3318 Inheritance And Estate Transfer Tax Return

How Much Does Probate Cost Free Consultation

Louisiana Retirement Tax Friendliness Smartasset

![]()

Louisiana Succession Taxes Scott Vicknair Law

What You Need To Know About Irs Form 8855 Canopy

It S Waiver Season In Louisiana Factors To Consider Louisiana Law Blog